Salzgitter shares under pressure: Armament fantasy dwindles before Trump-Putin conversation!

Salzgitter shares under pressure: Half-year figures confirm weakness, analysts warn of a challenging environment in the defense sector.

Salzgitter shares under pressure: Armament fantasy dwindles before Trump-Putin conversation!

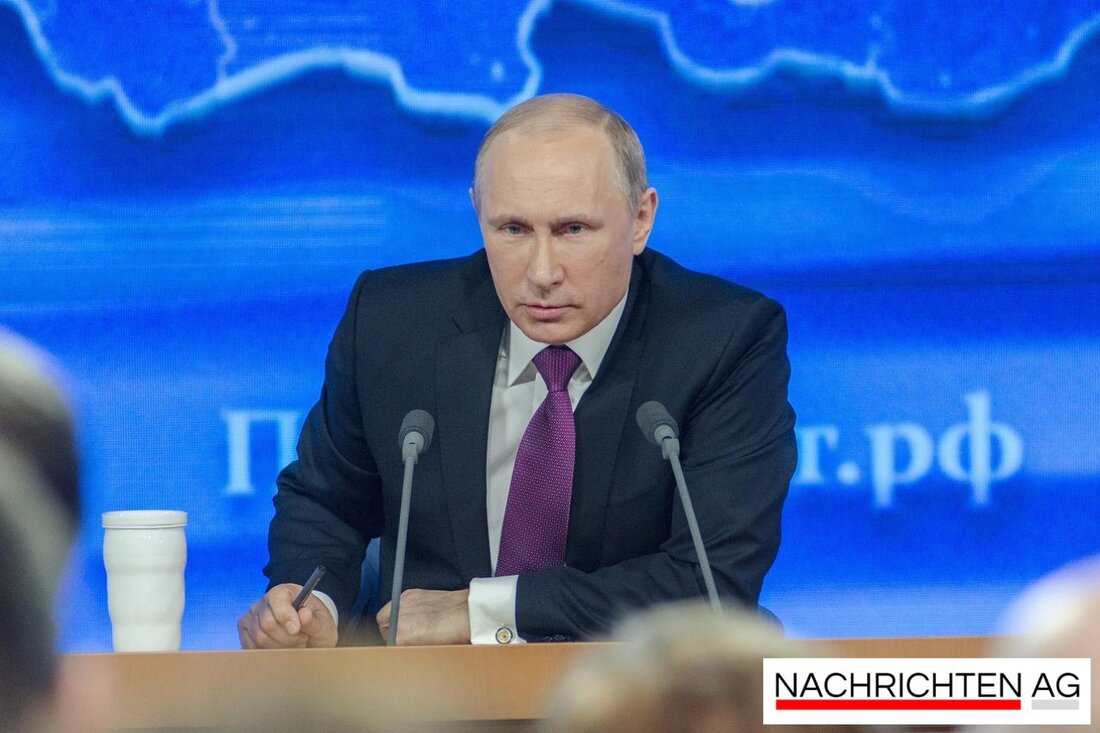

How is Salzgitter AG doing? This question is currently on the minds of many investors and observers. Salzgitter shares are currently under pressure because a planned exchange between US President Donald Trump and Russian President Vladimir Putin, which focuses on the conflict in Ukraine, is casting a shadow on investor sentiment. How the shareholder reports, Salzgitter AG presented its final half-year figures on Monday without impressing the markets with any new surprises. After a profit warning in July, there was no positive news to report, which resulted in the share price falling by 3.5 percent to 22.56 euros. Salzgitter is currently one of the eight weakest stocks in the SDAX.

One of the topics dominating the news headlines is the general weakness in arms stocks, which has also had a negative impact on Salzgitter. There is currently a mix of profit-taking and uncertainty in the industry, which is having a major impact on share prices. Analyst Cole Hathorn from Jefferies then lowered the price target for the Salzgitter share from 26 to 25 euros, but remains with his “Hold” rating. In his commentary, he highlights the medium-term benefits that could arise from the upcoming infrastructure investments in Germany, estimated at around 500 billion euros, and the EU steel action plan.

Armament fantasy: between skepticism and hope

Why is the hour for the defense industry now right now? While NATO is planning to massively increase its defense targets, Germany is responding with billions of dollars in investments and an increase in personnel in the Bundeswehr. Loud Capital magazine Analysts expect this to boost demand for defense technologies and equipment, which could have a positive impact on the share prices of German defense companies such as Rheinmetall and Hensoldt.

In this context, Salzgitter could also benefit from the increasing demand for defense steel. The past approval of armored steel by the Bundeswehr ensured positive expectations among investors, even if the current market mood is characterized by uncertainty. Analyst Dirk Schlamp from DZ Bank even raised the price target for Salzgitter from 21.50 to 23.00 euros. He believes this adjustment is justified, even if the challenges in the core business remain.

Market forecasts and investor behavior

Despite the challenges, Salzgitter shares are showing strong fluctuations and analysts agree: patience is needed. Looking at the 200-day line could provide chart support for some investors. The current environment is characterized by a mix of confidence and restraint, which is also influenced by geopolitical developments. It remains exciting to see whether and how Salzgitter can benefit from NATO's overall increasing defense spending and the EU steel action plan.

In conclusion, it can be said that Salzgitter AG has to assert itself in a dynamic market environment that offers both risks and opportunities. As important as it is to focus on the hard numbers, it is also crucial to keep an eye on the big picture. Obviously, steel and the defense industry remain a promising field, but one that is constantly changing Stock market news illuminated.

Suche

Suche

Mein Konto

Mein Konto